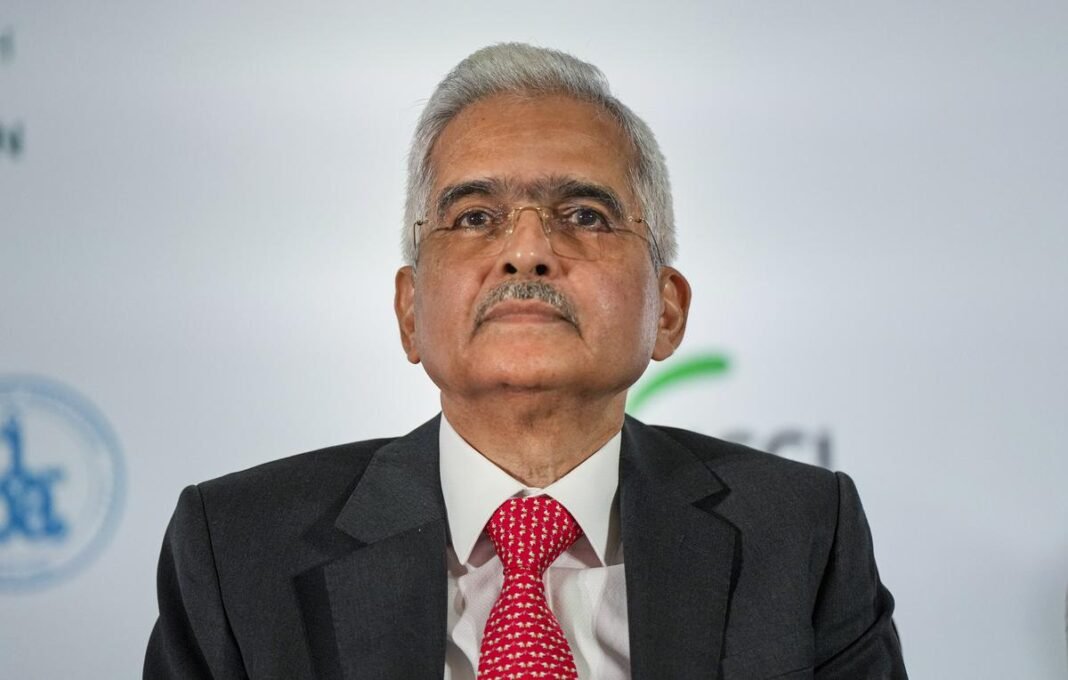

NEW DELHI, Nov 12 (PTI): RBI Governor Shaktikanta Das on Saturday said there was no need to change the inflation target despite the central bank’s failure to keep it below the 6 per cent upper tolerance level for 9 consecutive months while exuding confidence that the October print will be less than 7 per cent.

Inflation has been trending above the RBI’s upper tolerance level of 6 per cent since January this year.

The Reserve Bank of India (RBI) Act mandates that in the case of the inflation target not being met for three consecutive quarters, the central bank has to submit a report to the government explaining the reasons and detail the remedial actions it will be taking to check the price rise.

Earlier this month, a special meeting of the Monetary Policy Committee (MPC) was held to finalise the report explaining the reasons for missing the inflation target for three quarters.

This was the first time since the onset of the Monetary Policy Framework which came into effect in 2016 that the RBI explained its actions in a report to the government.

Speaking at the HT Leadership Summit on Saturday, Das said there is no need to change the goal post for inflation targeting as higher than 6 per cent inflation would hurt growth.

As per the mandate given to the Reserve Bank by the Union Government, the central bank is required to ensure that retail inflation remains at 4 per cent with a margin of 2 per cent on either side.

Quoting an RBI internal research, Das said inflation above 6 per cent for India would be detrimental to growth. It will be counterproductive because the financial savings and investment climate will be hit and India will lose the confidence of international investors if inflation remains above 6 per cent for a prolonged period, he noted.

The inflation band of 2-6 per cent also provides RBI enough policy space to use during times of stress, as was done during the Covid-19 pandemic. Although the inflation was about 5.5 per cent, the Monetary Policy Committee very consciously and quite rightly decided to tolerate higher inflation because during Covid-19 the priority was to support the economy by keeping liquidity easy by keeping the interest rates lower, he pointed out.

“We should not think of shifting the goal post because we have not been able to meet it. We remain committed to bring the inflation down to 4 per cent over a period of time,” he said.

Noting that internationally there is a debate on shifting the goal post, he said it would be too early to enter into that discussion.

As per a notification issued on March 31, 2021, the central government retained the inflation target at 4 per cent (with the upper tolerance level of 6 percent and the lower tolerance level of 2 per cent) for the five-year period April 1, 2021 to March 31, 2026.

Retail inflation in September increased to 7.4 per cent from 7 per cent in August on higher food and energy costs.

“We expect the October number which will be released on Monday to be lower than 7 per cent. Inflation is a matter of concern with which we are now dealing and dealing effectively,” he said.

For the last six or seven months, he said, both the RBI and government have taken a number of steps to tame price rise.

The RBI on its part increased the interest rates and the government also announced several supply side measures, he added.

Talking about the economy, Das said India will continue to be the fastest growing major economy with a likely growth rate of 7 per cent in 2022-23 on the back of strong macroeconomic fundamentals and financial sector stability.

The country’s economy remains resilient, supported by the banking and non-banking sectors, he added.

Das said the entire world has withstood multiple shocks. “I call it the triple shocks of Covid-19 pandemic, then the war in Ukraine, and now the financial market turmoil.”

The Governor said the financial market turmoil is mainly emanating from the synchronised monetary policy tightening across the world by central banks, especially those in advanced countries, led by the US Fed, and the spillovers are being felt by the emerging market economies, including India.

He further said in this kind of successive turmoil, the European Union is facing a recession situation, but there are possibilities that it will avoid that. The US is holding stable, but there are other countries where the growth has slowed down.

He also noted that there has to be coordination between the monetary authority and the government, which is the fiscal authority, because both are working in the interest of the economy.

Both are in the business of ensuring public good and these two institutions need to talk to each other and need to engage with each other, he said, adding the process of consultation has to prevail because both are dealing with the economy.

Coordination and engagement does not mean compromise of autonomy, he added.

On the Central Bank Digital Currency (CBDC), Das said it will bring down the cost of printing currency notes and also facilitate cross-border payments.

“It will facilitate international payments, cross border payments. It will be good for exporters and importers. The future belongs to technology and there could be a time where half the world or more than half the world will be on digital currency and you cannot be on paper currency.

“You will have to move in tune with the changing technological developments,” Das said.