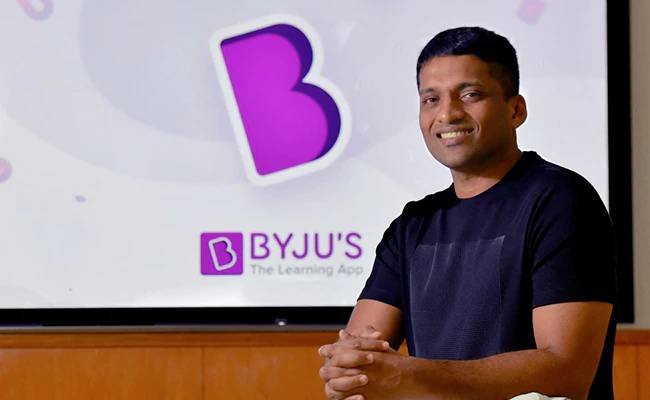

NEW DELHI, Feb 23: An Extraordinary General Meeting (EGM) of Byju’s shareholders got underway on Friday to vote on a resolution brought by some investors to oust founder CEO Byju Raveendran and his family over alleged “mismanagement and failures”.

Raveendran and his family stayed away from the EGM, calling it “procedurally invalid.”

Ahead of the EGM, a group of four investors of Byju’s on Thursday evening filed an oppression and mismanagement suit against the management of the company in the Bengaluru bench of the NCLT, seeking declaring of founders, including CEO Byju Raveendran, as unfit to run the company, appointment of a new board, declaring the just-concluded rights issue as void and a forensic audit of accounts.

Sources with direct knowledge of the matter said the EGM was to start at 0930 hours on Friday morning but was delayed for almost an hour as some 200 people, some of them are Byju’s employees, sought to join the virtual meet.

Only after due verification were the investors led in, they said, adding that some 40 people representing the investors were allowed in and would vote on the resolution moved by some investors.

However, the outcome of the vote at the EGM will not be applicable until March 13, when the Karnataka High Court will next hear Raveendran’s plea challenging the move by certain investors.

The High Court on Wednesday refused to stay the EGM, called by shareholders collectively holding more than 32 per cent stake in Byju’s. Raveendran and family own 26.3 per cent in the company.

The EGM notice calls for the ouster of the current board of Think & Learn, the firm that operates Byju’s, composed of Raveendran, his wife and co-founder Divya Gokulnath, and his brother Riju Raveendran.

Byju Raveendran on his part wrote to shareholders for the second time in a week saying the EGM was “procedurally invalid, contractually in contravention” articles of association and shareholder agreement, “legally on the wrong side of the Companies Act, 2013, and fundamentally designed and timed to create a media circus around it”.

Sources said he wrote that the investors seeking his ouster, have assumed the roles of judge, jury, and executioner.

He quoted the Wednesday order by Justice Anant Ramanath Hegde of the Karnataka High Court and said: “The decision, if any, taken by the shareholders of Byju’s in the EGM scheduled on February 23 shall not be given effect till the next date of hearing.”

He went on to add that he was confident of getting a favourable final verdict. Calling the EGM invalid, he said neither he nor any other board member (the others being his wife and brother) would attend the meeting.

Under the articles of association and shareholders agreement, the attendance of at least one of the founders was necessary to form the quorum for a valid EGM, he claimed, adding that if there is no quorum within half an hour of the scheduled time, the EGM cannot commence.

Investors, who are seeking the ouster of Raveendran and family from the Byju’s board at an EGM of shareholders for alleged “mismanagement and failures” at what was once India’s hottest tech startup, have also sought a forensic audit of the company in the plea filed before the National Company Law Tribunal (NCLT) on Thursday evening, according to a court filing.

As per the filing, the investors have sought declaring the present management as unfit to run the company and appointing a new CEO and a new board.

The plea also wants a forensic audit and a direction to the management to share information with the investors.

Sources said the plea seeks a declaration of the just-concluded USD 200 million rights offer as void and sought a direction that the company should not take any corporate actions that will prejudice the rights of the investors.

The petition has been signed by four investors — Prosus, GA, Sofina, and Peak XV — along with support from other shareholders, including Tiger and Owl Ventures. The plea has been filed to prevent value erosion for all shareholders as well as preserve worth for other stakeholders — employees and customers.

Concerns raised in the suit included financial mismanagement by the founders leading to losing control of Aakash, Byju’s Alpha (TLB loan) default, and prolonged corporate governance issues, including non-hiring of CFO and independent director.

Other concerns are about “oppressive nature” of the rights offer, alleged regulatory non-compliances, “oppressive, opacity and wilful defaults” in sharing information with stakeholders, and unauthorised corporate actions regarding acquisition of Singaporean edtech company Northwest Education Pte.

The plea has also mentioned about inter-corporate loans on undisclosed terms and multiple insolvency petitions filed by BCCI, TLB lenders, and Surfer Technologies Pvt Ltd.

The edtech firm in the last one year suffered other setbacks, including its auditor resigning, lenders beginning bankruptcy proceedings against a holding company and a US lawsuit disputing the terms and repayment of a loan.

Byju’s was valued at USD 22 billion in 2022 and it is now valued at USD 200 million in a rights issue.

To mollify investors, Raveendran earlier this week wrote to them saying he is taking more steps to ensure transparency on how the funds will be utilised and committed to restructuring the board.

Detailing the reasons for seeking the ouster, the notice listed alleged financial mismanagement, erosion of value due to management’s failure to enforce the company’s legal rights, and concealment of material information.

The investors who have called for the EGM vote include South Africa’s Prosus (9.10 per cent holding in Byju’s), Peak XV Partners (formerly Sequoia Capital) (7 per cent), General Atlantic (6 per cent), Sofina (5.70 per cent), The Chan Zuckerberg Initiative (2.40 per cent), Owl Ventures (1.30 per cent), and Sand Capital. It is the first instance of shareholders banding together to seek a change of guard in the company. (PTI)