By: Nantoo Banerjee

The country’s encouragingly high tax collections – indirect and direct – during the April-June quarter (Q1) of the current fiscal may have more to do with price and profit spurt than any magical growth of its economy and consumption. High wholesale and retail prices of consumables and industrial inputs are choking the growth of several sectors of the economy. The revised GST (goods and service tax) rates, which came into effect from July 18, are harsher at several mass consumption items. This is bound to impact the government’s future indirect tax collection growth and actual economic output.

In Q1, 2022-23, direct tax collection stood at Rs. 354,569.74 crore, up by 41.32 percent from Rs. 250,881.08 crore in the same quarter last year. Net indirect tax collection in Q1FY23 was Rs. 344,056 crore, a 9.4 percent increase from Rs. 314,476 crore in Q1 last year. The finance ministry expected GST collections to grow 27 percent in August to nearly 1.43 lakh crore. The actual collection exceeded the figure. The government said the economy is on course to grow at 7-7.5 percent during the current financial year.

If the high GST collection expectation is based on the lately revised tax rates, it may not hold good for long. According to the latest official data, GST collections in July at Rs 1,48,995 crore are the second-highest mop-up ever. The states to contribute the most were Maharashtra, Karnataka, Gujarat, Tamil Nadu and Uttar Pradesh. In absolute terms, Maharashtra collected the highest GST at Rs 22,129 crore, followed by Karnataka (Rs 9,795 crore), Gujarat (Rs 9,183 crore), Tamil Nadu (Rs 8,449 crore), Uttar Pradesh (Rs 7,074 crore), Haryana (Rs 6,791 crore), Telangana (Rs 4,547 crore), West Bengal (Rs 4,441 crore), Delhi (Rs 4,327 crore) and Rajasthan (Rs 3,671 crore), according to the latest official data.

The collection figures did not include GST on the import of goods. In terms of growth, Lakshadweep witnessed the highest jump in GST collection at 69 percent as compared with July 2021. It was followed by Puducherry and Ladakh (54 percent each), Nagaland (48 percent), Karnataka (45 percent) and Goa (43 percent). All major states reported growth above 15 percent. There are 28 states and eight union territories in the country.

In fact, GST collections exceeded Rs.1.40 lakh crore for the last six months in a row showing a growth of 28 percent. This could be almost entirely due to price inflation instead of higher consumption, production and compliance growth. Therefore, there is nothing exciting about the large monthly GST collection growth trend. The prices of commodities and finished products have been shooting up since the end of last year. The wholesale price inflation had spiked to 15.18 percent during the month of June while WPI for May was revised to 16.63 per cent from 15.88 percent. For July, WPI eased to 13.93 percent.

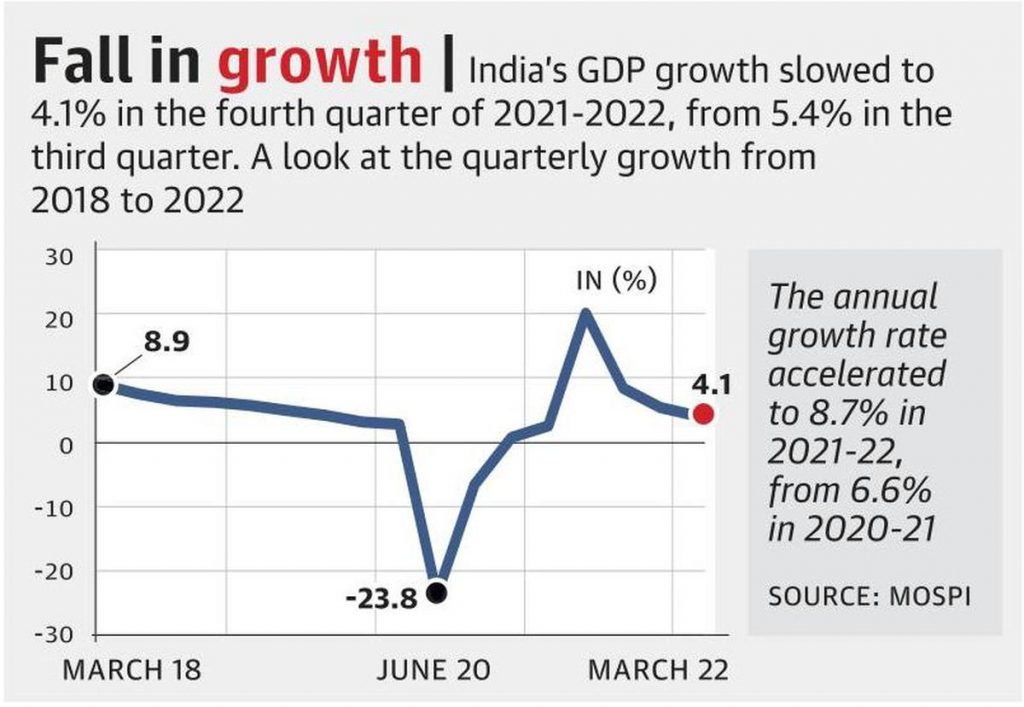

The entire economy is reeling under price pressure. The latest cut in India’s 2022-23 GDP growth forecast by several rating agencies, including SBI, Citibank and Moody’s, should be a matter of concern for the government. SBI has forecast the GDP growth at 6.8 percent. Moody’s had cut it further to 5.2 percent. They are far below the annual GDP growth forecast by the country’s National Statistical Office (NSO) on the basis of India’s GDP increase in the April-June quarter. It is not clear if the NSO forecast is on the ‘nominal’ basis. Nominal GDP doesn’t strip out inflation or the pace of rising prices, which can inflate the growth figure.

It may be noted that tax revenues in the last fiscal (2021-22) grew by a record 34 percent to Rs. 27.07 lakh crore. Direct tax collections went up by 49 percent while indirect tax showed a growth of 30 percent. The collection of corporate tax, which is part of direct tax, was up by 56 percent. Undoubtedly, this is a remarkable testimony to India’s rapid economic recovery after the successive Covid-19 waves in 2020 and part of 2021. In fact, the tax collection trend should have induced the government to take an encouraging lesson form the result of its historic direct tax rationalisation – from over 90 percent in the early 1980s to barely 30 percent at the highest level, now – to bring down the GST rates too and compress the slabs from five to three. Corporate Tax Rate in India may reach 25.17 percent by the end of 2022, according to Trading Economics global macro models and analysts expectations. India’s direct tax rates are globally competitive. However, the same cannot be said about its GST and outside GST items such as petroleum products and alcohol for human consumption. Excise duties on petroleum products are extremely high.

India has the highest standard GST rate in Asia and the second highest in the world, after Chile. It has the largest number of tax slabs. The GST regime, after the latest tax revision, does not spare even householders’ daily dire necessities. GST is imposed on pre-packaged and unbranded items such as wheat, rice, maize, fox nuts, specified flour, meat and curd. Apart from raising the costs for customers, the enhancement of the GST net is bound to further fuel inflation. In fact, the prices of several consumer products further shot up last month, following the expansion of the GST coverage. Higher taxes on inputs for processed grains, pulses and dairy, accounting for around 20 percent of the consumer price index basket, are expected to put further pressure on consumer prices and hit the poor people’s stomach. It is difficult to justify the latest GST revision which belied the expectation of the reduction of the number of slabs and overall rates.

Unfortunately, the policy makers – at both the centre and states – are yet to appreciate the logic of bringing down the GST rates and slabs to grow consumption, production and economy to collect more taxes in the process and ensure better compliance. It is well known that increase in demand for consumption leads to higher supply and production which ultimately helps grow the economy.

High level multi-prong GST will, in due course, reversely impact consumption and economy. Economic growth boosts GST collection. And, low GST rates can help boost consumption, investment and production in the long run. On the other hand, high and complex GST rates can affect consumption and economic growth. Therefore, future GST collections will depend on the growth performance of the Indian economy. The latest GST revisions are expected to worsen the problem of high inflation and reduce public trust on government measures to boost the economy. (IPA Service)