By: Sanjay Roy

The possibilities of persistent inflation seem to be looming large and a resultant contraction in demand primarily because of a cost-of-living squeeze is going to impact the growth rate, the forecast of which undergoes a downward revision in recent rounds by most rating agencies. The Russia-Ukraine war and the consequent rise in fuel and food prices are not going to cool down soon. Prices of food, metals, fertilizers and edible oil are on the rise at a global level driven by supply bottlenecks created by the war. Ukraine and Russia together account for 12 per cent of traded calories, 28 per cent of traded wheat and 75 percent of sunflower oil supplied across the world.

We have seen how edible oil prices soared when Indonesia, the supplier of 60 per cent of traded palm oil, announced a ban on exports to check the rise in domestic prices. A similar effect is likely as India decided to restrict exports of wheat particularly in the backdrop of an estimated 5-10 per cent fall in production and the increasing domestic prices. The food and fuel prices are expected to have further rounds of domino effect on non-food articles as well and that is being reflected by the persistence of the high wholesale price index.

Besides the consumer price index touching eight-year high levels of 7.8 per cent the wholesale price index (WPI) continues to be double-digit for 13 consecutive months and in April 2022 it was 15.08 per cent. Besides crude petroleum prices showing a 69.07 per cent increase in April 2022 on a year-on-year basis, other major contributors to high WPI are minerals recording a rise of 23.8 per cent and fuel and power inflation is showing a rise of 38.7 per cent on a year-on-year basis.

Due to the rise in input costs related to supply disruptions wholesale prices of manufacturing have also increased recording a 10.8 per cent rise in April 2022 on a year-on-year basis. It is also important that fall in the rupee as the exchange rate slid to 76.75 per US dollar has also made imports dearer and a net importer like India will be importing inflation as global prices of commodities and capital goods tend to rise. All these trends particularly indicate that the high consumer price index is not delinked from rising wholesale prices and this is not something from which we would be able to get rid of soon.

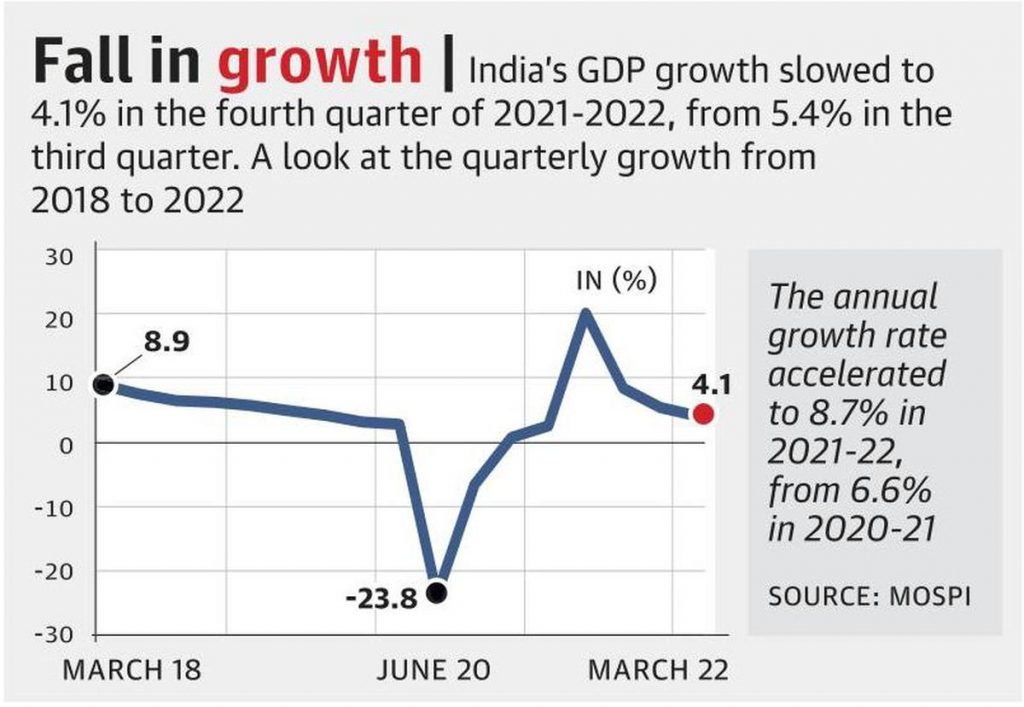

The recovery in the post-pandemic scenario faces problems due to severe demand contraction that was primarily because of income loss during the pandemic and on top of that high prices of food and other consumables. Growth forecasts are being revised downwards estimating a decline in private final consumption expenditure as well as in gross fixed capital formation. So, both consumption and investment are likely to suffer in the future. Market surveys suggest that the demand for vegetables and fruits in the mandis almost halved in the past two-three months. Soaring wheat prices have also driven the wholesale prices of cereals up.

The extreme temperature has taken a toll on wheat output in India but also on other breadbaskets of the world. On top of that, supply got choked due to war and Indian farmers were exporting wheat which also put pressure on domestic prices. Restrictions imposed on wheat exports would contain the increasing trends but wheat prices and also wheat flour related products show an escalation of prices which will be forcing poor people to cut down their calorie intake. Besides food, demand for other consumer goods also suffers contraction. Due to the rise in input costs most of the FMCG companies have either resorted to what is known as ‘grammage reduction’ meaning a reduction of volume in revised packages or simply increased prices. Prices of soap, detergents, toiletries, food and beverages, noodles, and biscuits saw an unprecedented rise in prices in the past few months. Consumers as a response tend to buy lesser amounts or cut down their expenditures to fit with their budgets.

In response to rising inflation, the Reserve Bank of India announced its off-cycle repo rate hike of 40 basis points on May 4. Following this announcement, many banks have immediately raised their lending and deposit rates. The assumption of this monetary stance of the central bank of India is that raising interest rate would make savings more attractive and credit would be costlier, as a result, the supply of money in the economy would decline and this would eventually moderate the rising prices.

Commentators on the media also suggest that another rate hike is likely to happen during the June monetary policy announcement as RBI is focussing more on inflation targeting which went to the backseat in previous months as growth recovery was the prime concern. But such policies assume that the central bank has full control over the supply of money, which is actually not the case as credit money plays a very important role beyond currency notes and various instruments may play the role of money, the supply of which is not exogenous to the economic system.

Also even if the cost of credit increases in a situation where corporates enjoy a monopoly over markets, they would be able to transfer the burden to consumers in the form of enhanced prices. Moreover, the current episode of inflation is driven by rising costs rather than being flared up by increased demand. Therefore, a direct intervention of the government to control prices of food and necessaries through the public distribution system and also restore demand through income protection for the poor seems to be more effective in a situation of stagnating demand coupled with rising prices.

It is also important to note that the rise in the interest rate in the US has caused a massive outflow of FIIs and the response of RBI to raise interest rates might be driven by a desperate attempt to prevent capital outflow. The outflow has caused a widening of the current account deficit and the rupee suffers a steep fall vis-à-vis the US dollar. As a result, imports have become costlier while exporters can take some advantage of declining dollar prices harnessing higher demand in exports. However, India being a net importer and since our exports are increasingly dependent on imports, the rupee fall is likely to fuel inflation further. This may provoke a further rise in interest rates followed by a dampening of demand.

All these boils down to the crucial fact that in the post-pandemic scenario recovery of growth is going to face serious challenges of low demand for food, and non-food articles and more importantly persistent inflation is going to eat away the already lowered income of the working people. The impact of inflation and the distribution of burden invoke conflict between classes on how powerful the contesting groups are capable of adjusting their returns through changing prices.

In India, since the vast majority of workers are employed in the informal sector and also a rising share of those in the formal sector are contract workers fight for higher wages to compensate for rising prices and its expectations become difficult for a majority of the workers. The recent agitations and strike actions by Left trade unions are bringing together workers from different segments to raise their voices for democratic rights and income protection but such institutional protection is yet to be realised.

On the other hand, the ruling class or the big corporates with their monopoly control over most of the markets would be able to increase prices and pass on the burden of inflation largely to the consumers while keeping their profit rate more or less unchanged and in cases may increase profits fuelling speculative gains. Since a majority of the consumers are wage or salary earners with a minuscule minority having provisions for necessary price indexed allowances, the burden of inflation would largely fall upon the working people of our country. Hence demanding necessary intervention through public distribution system as well as protection of income against price rise has to be one of the major issues of struggle for the working people in the coming days. (IPA Service)