HT Bureau

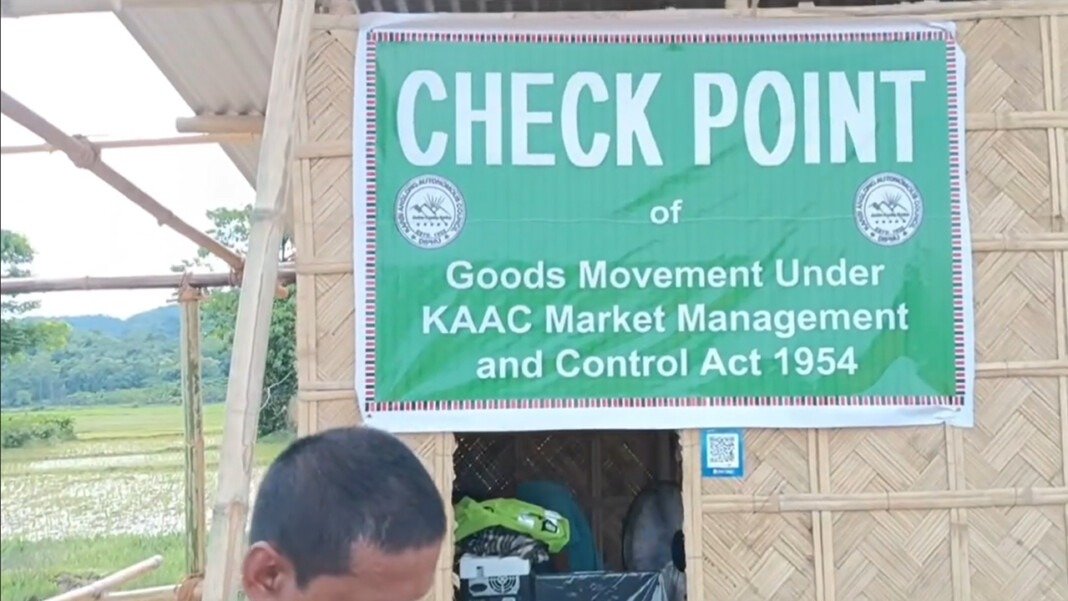

DIPHU, July 25: The Taxation department of the Karbi Anglong Autonomous Council (KAAC) has established dedicated checkpoints for the entry of goods at Samding Bey village, Parokhuwa along NH-36, and at Garampani on NH-39.

These checkpoints, operational under the KAAC Market Management Control Act 1954, aim to enforce trading fees and regulate trading licenses, as well as monitor the movement of goods entering and exiting Karbi Anglong.

Mohen Bey, involved in issuing Transit Pass (TP) and challans at the Samding Bey checkpoint, explained, “The checkpoints have been established to impose trading fees, verify trade licenses of traders, and track the types of goods entering and leaving Karbi Anglong. They also serve to prevent the illegal entry of goods.”

He expressed approval of the initiative, emphasising that these checkpoints will enable the Taxation department to generate significant revenue. Initially launched on a trial basis at Samding Bey village, Parokhuwa and Garampani, similar checkpoints are planned for Lahorijan, Khatkhati, and West Karbi Anglong in subsequent phases.

Regarding operations in the Parokhuwa area, Bey clarified, “The KAAC entry tax gate at Parokhuwa market monitors the daily influx of commercial vehicles into Karbi Anglong. Meanwhile, the Samding Bey village checkpoint focuses on verifying trade licenses and overseeing goods movement.”

Bey further highlighted concerns about illegal activities detected through the Samding Bey checkpoint, noting instances where traders failed to renew licenses or lacked proper documentation, resulting in revenue losses for the Taxation department.

He also advocated for the inclusion of stone crushers under trading activities to enhance revenue collection, particularly from those supplying materials for national highway construction.

However, Bey acknowledged public apprehensions about potential price increases due to the new checkpoints, assuring that minimal trade fees imposed on traders would not significantly impact market prices.

Chief Executive Member (CEM) of KAAC, Tuliram Ronghang emphasised the authority of the KAAC under the Sixth Schedule of the Indian Constitution to independently levy taxes on trades, including animals, underscoring the rationale behind the establishment of these checkpoints for goods entry.