By: Prabhat Patnaik

Government officials never tire of repeating that India is currently the fastest growing major economy in the world. What they never mention is the fact that India had witnessed perhaps the sharpest absolute drop in GDP among the major economies of the world in 2020-21 because of its draconian lockdown; and the current growth-rate is exaggerated by the low base caused by that drop from which it is being counted.

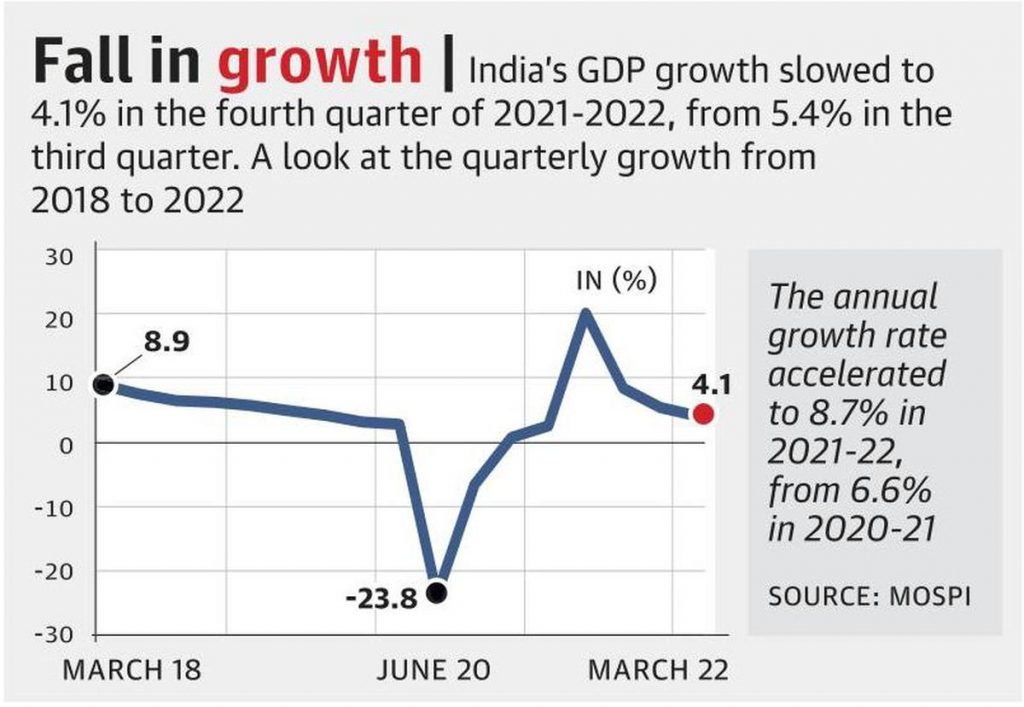

If we compare 2021-22 GDP with that of 2019-20 which precedes the lockdown then it is only 1.5 percent higher; and since the 2022-23 GDP is estimated both by the IMF and the Reserve Bank of India to be 6.8 percent higher over the previous year, this would mean that the 2022-23 GDP will be only 8.4 percent higher than in 2019-20. Hence the annual compound growth rate over the three years from 2019-20 and 2022-23, even ignoring the absolute drop in between is only2.7 percent! Further, even this meagre recovery from the drop is not being sustained: the 2023-24 growth rate is expected to be below that of 2022-23.

Almost all agencies have downgraded their growth rate forecasts for 2023-24; and almost all of them put this growth below the growth rate for 2022-23. The IMF for instance expects the Indian economy to grow at 5.9 percent in 2023-24 which is considerably lower than its figure of 6.8 percent for 2022-23. It is this expected slowing down that is relevant, not the absolute figures which are neither conceptually not statistically very meaningful: indeed a former chief economic advisor to the union government had suggested that the entire set of growth rate figures, even focussing on the GDP that is itself a flawed concept, had been significantly exaggerated. Such a slowing down is now generally expected; and the fact that, even after an utterly stunted recovery from the lockdown, there is general expectation of a further deceleration of the growth rate, is of great significance.

Indeed the expected growth rate will be even lower because of a new development, viz. the recently announced OPEC+ cut in oil output by one million barrels per day, which would become effective from May1 and which comes over and above the two million barrels per day cut announced in October last year. This would affect India’s growth rate in at least two distinct ways: one, it would make inflation control in the US that much more difficult, forcing a further increase in US interest rates, which would lead to a depreciation of the rupee vis-à-vis the dollar, accentuating inflation in India; to prevent financial outflows from India and the ensuing depreciation of the rupee, the interest rate in India too would have to be raised which would have the effect of lowering the growth rate. Two, even leaving aside the effect mediated through the US, a rise in oil price would have a directly growth-lowering effect: the expenditure stream on national output gets reduced because of a reduction in net exports (arising from a rise in the import billowing to the oil price-rise).

But even leaving aside the latest oil price hike, the growth rate is still expected to slow down; in fact, according to the RBI’s estimate even the growth rate of 4th quarter GDP in 2022-23 is going to be less than that of the 3rd quarter, 4.2 percent compared to 4.4 percent. The question is: why is India’s meagre recovery from the pandemic-linked drop in output petering out?

The basic reason has to do with the nature of a neo-liberal economy. Private consumption in such an economy keeps getting reduced as a proportion of output because of the increase in income inequality that occurs; this means that private consumption, other than what may occur independently of income, cannot provide a stimulus for income growth. Private investment on the other hand depends on the expected growth in the size of the market for which the actual growth rate of the economy provides an indicator; this means that private investment too cannot provide an independent stimulus for growth. Government expenditure too is limited as a proportion of income because fiscal deficit as a proportion of GDP is limited; it cannot therefore provide an independent stimulus for growth unless the government can raise the tax-GDP ratio by taxing the rich, which global finance dislikes. It follows therefore that the stimulus for growth under neo-liberalism comes from only two sources: net exports, and asset price bubbles which can give rise to an increase in consumption independently of income.

But in a world economy where there is general stagnation and even a tendency towards recession (engineered everywhere as an antidote to inflation), exports, far from increasing, will themselves experience slowing growth. And asset price bubbles are not very effective in generating additional consumption demand within our economy; they enrich at best a thin stratum of persons whose consumption demand largely leaks out abroad. It follows therefore that there is no reason to expect an increase in the growth rate of the Indian economy; on the contrary the tendency will be for a decline in growth rate because of slowing investment growth and slackening consumption demand owing to growing income inequality. Even the IMF attributes the expected slowdown in India’s economic growth to sluggish private expenditure, both on consumption and investment, and the general stagnation in the world economy which is slowing down export growth. Government expenditure growth, itself lacklustre, cannot offset the slowdown caused by these factors.

Even within its overall limitations however there is a way that the government could stimulate the economy; and that is by changing the composition of government expenditure. To appreciate this point, consider two different ways that the government can spend the same amount, say Rs 100; it can spend it by providing transfers to working people, or alternatively it can spend the amount on modern infrastructure projects, as the 2023-24 union budget plans to do. If a hundred rupees is handed to the working people, then more or less all of it will be spent; and it will be spent on goods and services which are produced mainly in the small-scale sector where the profit margins (and hence savings per unit of income generated) are generally lower. On the other hand if the same amount is spent on modern infrastructure projects, then at every stage, both at the beginning and at every round of expenditure that is subsequently generated, the amount spent will be less; there will always be larger leakages into savings and imports. This means that the “multiplier” effects of spending on modern infrastructure will be less than those of spending on transfers to the working people.

It follows that even when the total government expenditure cannot be increased, how exactly it is spent can still make a difference to aggregate demand, and hence to the growth rate of the economy. And public expenditure that takes the form of transfers to the working people or that augments the welfare of the working people has a larger multiplier effect than public expenditure incurred for any other purpose.

Two clarificatory comments are needed here. First, this argument will not be valid if the economy is constrained on the supply side, if for instance there is a shortage of infrastructure that is holding up the growth rate; but that is not the case in India at present. Our economy is constrained on the demand side, as even the IMF concedes. Second, it maybe thought that any transfers to the poor or working people will create a larger demand for foodgrains, of which there are stocks held by the government that will be run down; such transfers therefore will have no multiplier effects. But the weight of this argument is much less at present than earlier because in the context of the pandemic the government has been pushed into providing foodgrains to several poor households, so that the extent of grain deprivation now is not as large as usual. At the margin therefore any transfers to the working poor would create demand for goods and services whose output can be expanded, and this would have substantial multiplier effects as claimed above.

Larger multiplier effect entails the creation of larger employment. It follows therefore that even within the constraints imposed by a neo-liberal regime on government expenditure as a proportion of GDP, by ruling out both greater taxes on the rich and a larger fiscal deficit; there is still some elbow room for the government through changing the direction of government expenditure. Such a change would not only expand income and hence reverse the decline in the growth rate, but would also generate larger employment which is a desideratum in itself, and also provide relief to the working people currently groaning under the weight of the economic crisis. The Modi government however has concern only for crony capitalists, not for the working people. (IPA Service)